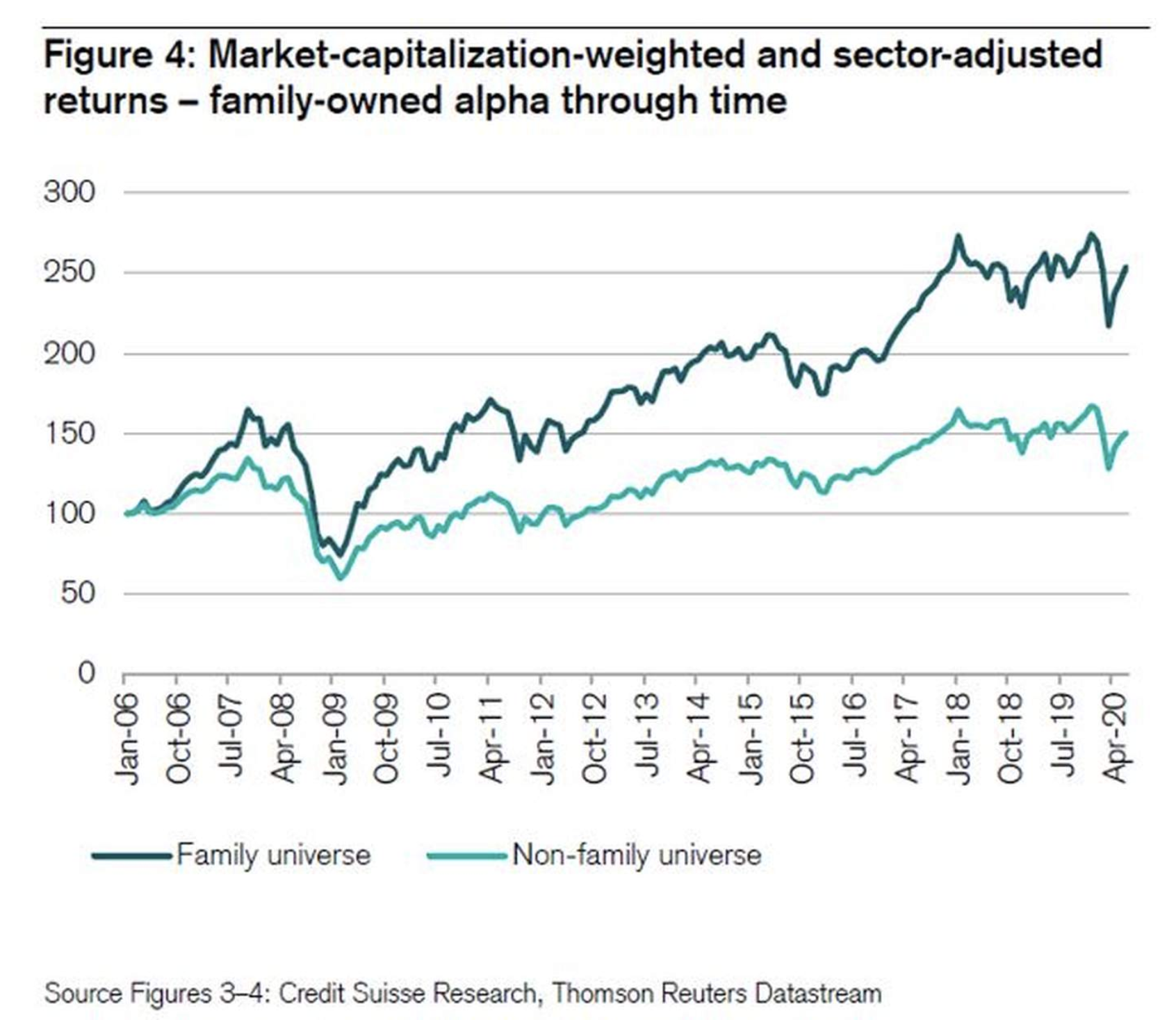

Successful Investors are drawn towards successful businesses. And when I say successful businesses, I’m not referring to those standard ‘run of the mill’, ‘provides good returns’ type companies that most investors look for, but those that actually stand out from the crowd due to their innovative people and practices. These businesses are typically mavericks and icons that are industry leaders and are globally recognised for such. But the real power in these companies is that, once identified, they offer much more than just sound investing value - they allow us to learn from them. And its powerful learning, indeed; we not only learn what makes these companies tick, but also the minds of their founders or managers and what sets them apart from their competitors. Its this knowledge that often gives us an edge when we come to select future investment opportunities. This knowledge, more than anything, can teach us more about investing than the standard run of the mill quantitative methodologies that are still taught in most schools.

“If finance were — when finance is properly taught, it should be taught from cases where the investment decision is easy. And the one I always cite is the early history of National Cash Register Company, and that was created by a fanatic who bought all the patents, and had the best salesforce, and the best production plants. He was a very intelligent man and passionately dedicated to the cash register business. And of course, the cash register business was a godsend to retailing when cash registers were invented. So that was the pharmaceuticals of a former age. If you read an early annual report prepared by Patterson, who was CEO of National Cash Register, an idiot could see that this was a talented fanatic. The investment decision was easy. If I were teaching finance, I would collect a hundred cases like that. And that’s the way I would teach the students.” Charlie Munger

Given Charlie Munger’s success in the world of investing, his advice is worth heeding. Rather than relying on quantitative tools like spreadsheet modelling, beta calculations, or discounted cash flow analysis, Munger takes a more holistic approach, focusing on the key elements that will shape a business's future prospects. This approach is also shared by Warren Buffett, who famously remarked, "The only way we know how to make money is to try and evaluate businesses."

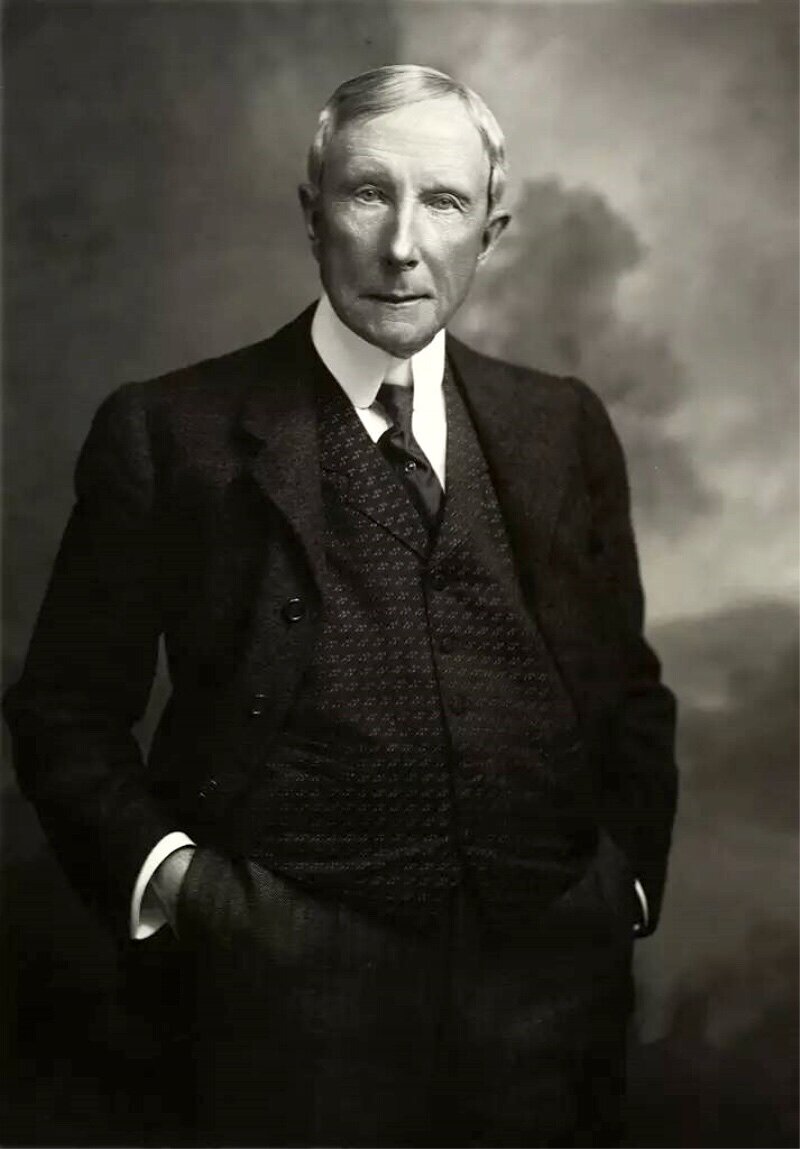

The business traits that consistently emerge as critical factors for a company's success have stood the test of time. From the titans of industry like Vanderbilt, Rockefeller, Henry Ford and John H Patterson, to modern-day icons like Jim Sinegal of Costco, Arthur Blank of Home Depot, or Yvon Chouinard of Patagonia, much of it has to do with people, human nature, and the process of innovation. None of these have changed much over time.

John H Patterson’s story is a fascinating one of entrepreneurial success. At the age of just twenty-five, he began selling coal on the side while doing his job managing a toll booth on a canal. Through his dedication to providing customers with more than they expected and always delivering on his promises, he quickly learned how to differentiate himself in a commodity business. Within a year, he had become a successful coal merchant.

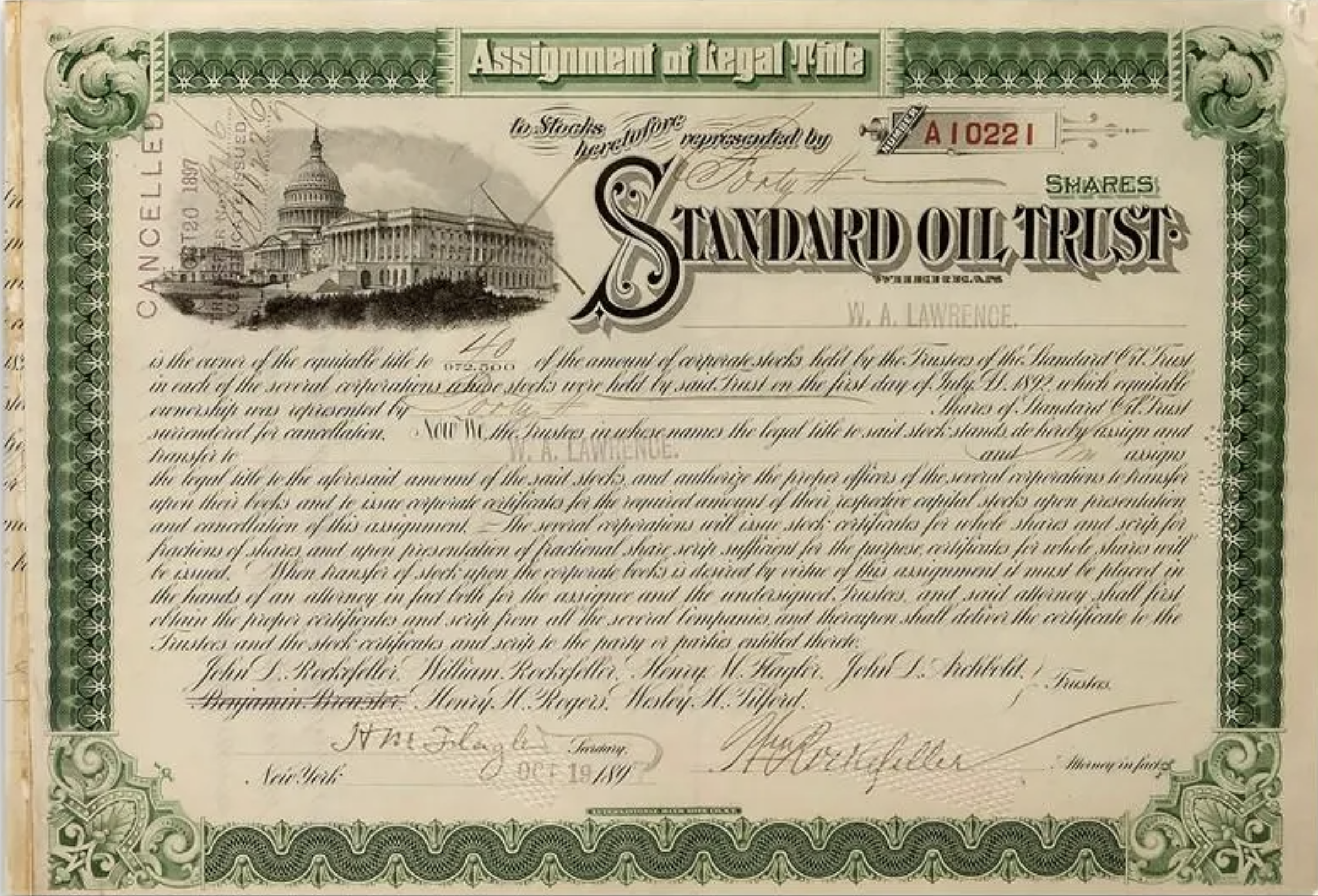

As Patterson's success continued, he began to acquire additional assets, including a store, coal mines, and railways. However, despite his efforts, the store struggled to turn a profit. He eventually discovered that his clerks, incentivized to win customer favor and maximize orders, were consistently undercharging. To remedy the situation, he promptly fired the three clerks and installed two cash registers in their place. The change was so successful that Patterson and his brother underwrote a new script placement by the cash register’s maker, the National Manufacturing Company. A year later, after the company reported a loss, he had dumped most of the stock.

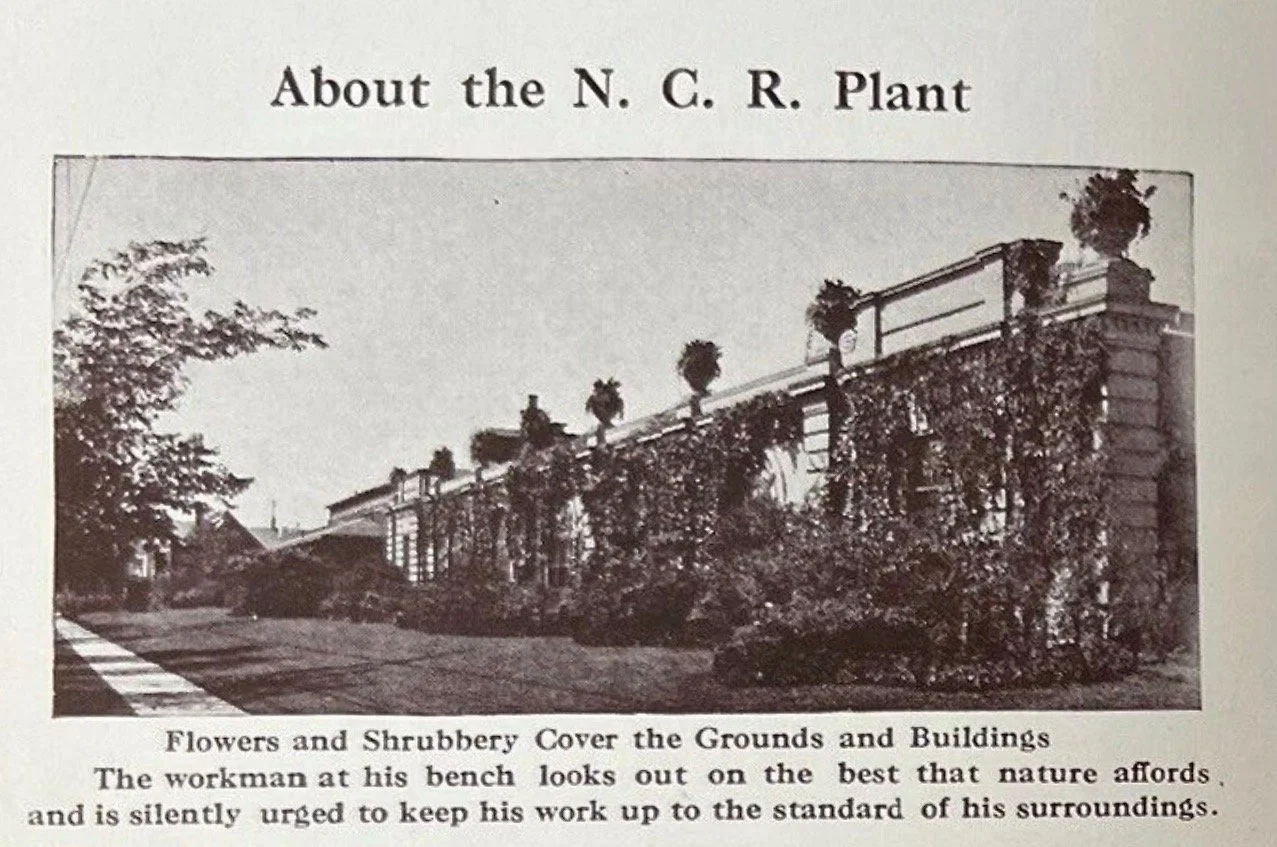

Picture Credits: NCR Annual Report 1906

When Patterson later stumbled upon a store manager whose business was being successfully run in his absence thanks to a few National Manufacturing cash registers, he grasped the potential of the machines to revolutionise American business. He determined to buy the company, offering the owner $6,500, which he accepted. The following day, Patterson offered $500 to annul the contract, but the owner refused. The seeds of an almost forty-year reign over the National Cash Register Company had been planted.

“I have in my files an early National Cash Register Company report in which Patterson described his methods and objectives. And a well-educated orangutan could see that buying into partnership with Patterson in those early days, given his notions about the cash register business, was a total 100% cinch.” Charlie Munger

Although nearly a century has passed since John H. Patterson passed away, the business principles he advocated for remain just as relevant today as they were in his time. Below, I've shared some of my favorite excerpts from Andrew Crowther's excellent book, "John H. Patterson: Pioneer in Industrial Welfare." Additionally, thanks to the detective work of Jessie Rancourt, you'll also find extracts from the 1906 Annual Report that Charlie Munger referred to in a speech given at the USC Business School in 1994.

Hire Right

“We get the best class of people to come with us. Mr. Rockefeller, of the Standard Oil Company, says that success depends upon the selection of the right people.”

Tone from the Top

“A boss whom the workers can see daily toiling away harder than any of them is certainly the one who will get the most work from his men.”

“Business is founded on confidence; success on co-operation.”

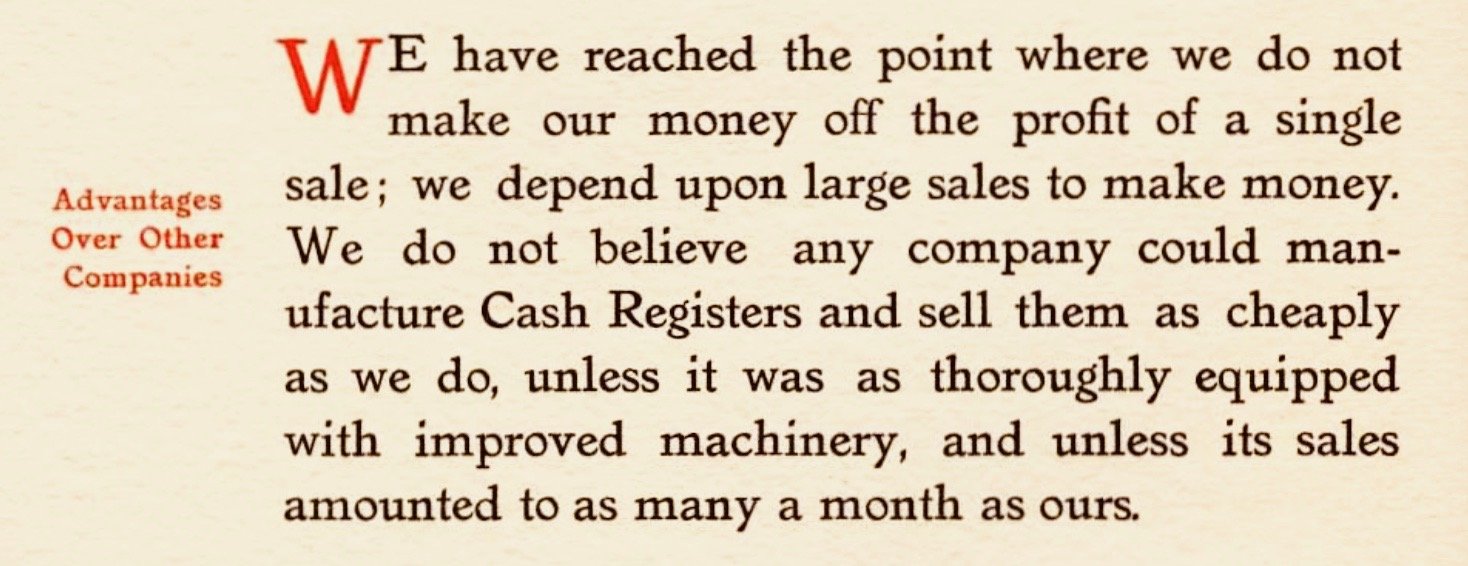

Volume

"Charge a profit, a reasonable profit, but always a profit on every sale. Then make your real money by volume of business."

“Everybody knows that profit is the difference between expenses and receipts, and yet fully one half of the business men make more effort to cut down expenses than to increase their receipts.”

Exceed Customer Expectations

“Patterson said that no one had a right to expect business unless he satisfied customers. Every customer got what he paid for and a little more.”

“The smallest complaint was a personal affair for John Patterson and he settled each complaint to the absolute satisfaction of the customer and regardless of expense.”

"Every business which works for the betterment of humanity should be eagerly pressing forward and not waiting to be shoved forward. There are those who say that successful selling depends upon knowing what the public is asking for and then giving it to them. I do not agree with this viewpoint. I do not think that real success is attained by following in the wake of the public. My idea of successful business is this: Fill not only every known want of your customers but also have in ready reserve that which you calculate they are going to need next year or the year after.”

“We had to educate our first customers; we have to educate our present-day customers; and our thought has always been to keep just so far ahead that education of the buyer will always be necessary. Thus the market will be peculiarly our own our customers will feel that we are their natural teachers and leaders.”

Loyal & Repeat Customers

“The first sale of any device is to be considered only as a first lesson to the consumer. The big sales are always in the future.”

Appearances

“The offices had to be clean. Mr. Patterson was about as neat a man as ever lived and everything about him had to be likewise. He thought that no man could do accurate work amidst disorder.”

Source: ‘From One to a Million’ 1911.

“It was Mr. Patterson’s nature to prescribe for his business and for those about him in every detail. He wanted all his salesmen and executives to be well dressed. In later years, when money was freer, he had a way of rounding up the men in the offices and sending them to New York "to get the hayseed off them." He would send men with orders to tailors for several suits of clothing; he bought travelling bags and neckties by the dozen. If a man were not shaved he would present him with a razor.”

“Do not hide your office on a side street or upstairs where no one can get at it. Have it where it will be easy to get at; fix up good window displays that will attract attention; have competent men to show machines to those who come in, and you will sell more machines in your office than you have ever before, and not only make your rent, but a handsome profit besides. ‘Light and cleanliness are the two great essentials to selling. A dark store is never as profitable as a light one. People are attracted by light. Many a store can be made light by knocking a few more holes in the wall. No one has yet failed in business because he spent too much money in lighting his store’”

Open-minded

“It was possible to show him that he was wrong and he would reverse himself in an instant. For John Patterson, curiously enough, never had any pride of opinion; he was for some idea not because it was his but because it was right; show him that the idea was wrong and he was for the new right just as energetically as he had been for the old right!”

Humility & Frugality

“Whenever business was booming and the sales people were congratulating themselves on how good they were, Patterson had a habit of drawing a wiggly line which by convention was known to be a snake and then lettering under it: "When the sun shines, look out for the adder."

“In the later years of his life, Mr. Patterson had a personal income of about half a million dollars. He could as easily have had double that income but he preferred to have the money stay in his institution. He made no investments of any kind. He had a modest house overlooking Dayton and a small camp in the Adirondacks. He bought a great tract of land with the idea in view of selling home sites to those who worked with him and of providing a natural park where the people of the city might get fresh air. Eventually he gave the tract to the city. He probably spent less money on himself than any rich man in the country. The remainder of his income he gave away and most of it he gave away personally with the sole idea of making better citizens, or, as he liked to put it, ‘making better business.’”

Incentives and Uncapped Earnings

“It is not human nature to work as hard when an income is assured as when the income depends solely on the effort exerted. It was not a new idea to put men on commission. It was a new idea to put them on commission in order that they could earn more. Patterson started in at once to help them to earn more.”

“The N. C. R. agents thought that if they made too much money Mr. Patterson would immediately cut their commissions. They could not understand any other course, and there was no reason why they should understand any other course. It was one of Mr. Patterson's hardest tasks at this time to convince the sales force that the N. C. R. interest was in having the largest possible number of cash registers sold and that the company could not make any money unless the agents did.”

Source: ‘From One to a Million,’ NCR 1911.

“If you can sell a million dollars in a week, we'll hire a brass band to take your commission to you. We can't make any money unless you do." Mr. Patterson's actions in refusing to cut commissions were severely condemned by many men in business.”

“The profit-sharing plan has been many years in the making and is still in the experimental stage. Mr. Patterson approached wages never with the thought of how little he could pay, but first to see how much he could pay, and then to find what he could give in addition to the wages.”

“The plan was put into operation for the first time in 1917 and in its final form it operates in this fashion. (The executives under the plan do not receive salaries quite as large as they might receive in other companies of similar size. Their fortunes depend upon the fortunes of the company, but the workingmen have their shares over and above the highest going wages.) The profit-sharing plan provides that, after deducting from the year's profits a sum equal to 6 per cent interest on the money invested, the remainder is divided equally between the company and the employees. The half that goes to the company is used for buying additional land, buildings, machinery, inventions, and similar expenditures necessary in an expanding business. The company takes all the risk; the employees take none; but every increase of efficiency or elimination of waste on the part of an employee is reflected in the amount of the profits in which he shares.”

“Three distributions of the profits are made to the employees each year..”

“One half of the employees' share, or 25 per cent of the total profits, is given to the managing employees, including executives, department heads, and their assistants, of which there are approximately 600. The remaining 25 per cent is divided between all other employees in the office and factory, with the exception of those who have been employed less than thirty days.”

“This dividing of employees into groups is done on the theory that those who contribute the most to the making of the profits are entitled to the largest share in them.”

“Under this plan, not only do all employees, from the general manager to the messenger boy, have the incentive to do their best in their positions and thereby earn more profits, but the employees in the B, C, and D groups have the added incentive to advance into a higher group.”

Quality

“Our Test Department carefully examines the materials used to make National Cash Registers. We believe that nothing is too good for the merchants in all parts of the world who use these machines. Each register is rigidly inspected several times as it is built.”

Tough Times

“We can drop with business or we can build a bridge and go across. Let's build a bridge." His way of building a bridge was to intensify every sales effort. Patterson did not draw in for a panic. He put on extra effort, and each panic marked a substantial advance by the N. C. R. The company really grew up in the Panic of 1893.”

“Mr. Patterson met that depression as he had met every other depression- -by drawing up a new sales plan, by holding conventions all over the country, by extending his advertising (Mr. Patterson always enlarged his advertising when business was bad for it was then, as he said, it was most needed), and by putting on sales pressure from every direction.”

“Patterson believed that cutting down expenses to make ends meet was the surest possible way to prevent them from meeting. He held that cutting down expenses cut down initiative and energy. If his bank account became anaemic, he went right out after the fresh blood of new business. He doubled his volume in the depression following the Panic of 1893. John Patterson was always at his finest when in trouble. He fairly revelled in it.”

Innovation & Continuous Improvement

“[Patterson implemented] the policy of never considering the product as finished and which was to resolve into a definite policy a few years later when he formally established the inventions department, which became so famous.”

“Patterson said to his people and repeated thousands of times afterward: "Send in the complaints. They are our schoolbooks from which we learn what is needed and how to remedy the difficulty. We propose so to improve the quality of our registers as to make them look as finished as a watch."

“Every idea that seemed to have merit was tested. It was axiomatic that everything being done by Patterson’s company was to the end of preparing to do it better.”

“With the new building came the formal establishment of one of the fundamentals of the success of the company and an idea which Mr. Patterson was the first to work out the Inventions Department. Previously Mr. Patterson had himself been the department.”

“Patterson had it firmly fixed in mind that the product must ever be improved, and gradually this became an integral part of the business.”

“We shall continue to experiment and give all ideas scientific, thorough, and practical tests before putting the same on machines. No expense or trouble will be spared to fully try all ideas advanced to us by our representatives, or to try and overcome any fault that may be discovered in the present machine.”

“The business that is satisfied with itself, with its product, with its sales, which looks upon itself as having accomplished its purpose is dead. The actual burial may be postponed; but it is dead because it is not going forward. To my mind, nothing can ever be good enough.”

“I am always dissatisfied; I preach dissatisfaction. I can always see where something might be better; and therefore our business is never at rest and I never want it to be. The throbbing heart of business is the intense desire to do better. When that desire ceases, the heart stops.”

“Patterson was afraid of contentment. He was afraid of people around him becoming content. He refused to believe in perfection other than as a goal far off that could never be reached. He would seldom praise a good piece of work and if he did he would join an exhortation with the praise, as: "That's fine, now do better.”

“Much of the growth of this business is due to the constant improvement of our product. For thirty-six years every effort has been made to make National Cash Registers meet the needs of merchants in all parts of the world. We are never satisfied, but are always trying to improve.”

Filling a need

“Patterson went into the making of cash registers only because he thought every merchant would eventually have to use one. Thereafter he worked on the theory not of supplying what the buyer wanted for the buyers then did not want cash registers; he worked on the theory of supplying what the buyer could use to the best possible advantage once he had been taught the need.”

Advertising & Social Proof

“Advertising differed from any which up to that time had been seen, in that every piece held a reason why the purchase of a register would make money for the purchaser. It was educational advertising. He borrowed from the patent-medicine people the wrinkle of attaching testimonials of satisfied users.”

"‘We know nothing about advertising,' said Mr. Patterson,’ but we want to learn. ‘Some day we will have a big business. Good advertising will get it for us. Visit the agents. Secure all the ideas from them that you can. Find out their needs. Those men are in the field and they know what is needed.’ John H. Patterson never pretended to know anything about advertising, but as a matter of fact he was probably the first man in any business other than the patent medicine to make advertising an integral part of his business.”

Word of Mouth

“From the beginning Mr. Patterson insisted that no advertising could equal the word-of-mouth advertising of the satisfied user.”

“Patterson recognized that the best salesmen were contented customers and so he made it a primary principle that any man who bought must not only be satisfied with the purchase but must be kept satisfied by being instructed not only how to use his machine, but also how to make money out of it. Considering his ideals, any other course was impossible to him.”

Low Prices

“The object of The N. C. R. Co. is to stop the open cash drawer - to sell at lowest prices and benefit the billion. National Cash Registers are the lowest-priced machinery sold in the world.”

Reinvestment & Retained Earnings

“From the very beginning Patterson regarded a profit not at all as a personal perquisite but as something to put back into the business to make it bigger and better. He put back the profits with supreme confidence. He was always willing to go down with the ship.”

Obliquity

“One of the reasons for Patteron’s success was that from the very first he had objectives larger than his business—he never worked for money as money. He did not believe in sharp shooting for profits. He wanted his money to come as an incident to service. One finds that men do not create success—whatever the definition of the moment may be—unless they believe in themselves and in what they are doing.”

Good Profits

“Mr. Patterson insisted then, and it is now everywhere considered a sound sales policy, that a sale should not be made to any one who could not make money out of what he bought. His messages all went to show the merchant's need of a register and not the N. C. R.s need of a sale. There is a distinction here which is not yet universally grasped.”

Transparency

“Mr. Patterson wanted to be constantly in touch with all of the agents. He thought that a business should not have secrets but that what one agent knew was good for every other agent to know. He believed that the progress of business depends upon the interchange of information among those in business.”

Internal Competition

“Mr. Patterson not only put into The N. C. R. (a bulletin to salesmen) the records made during the month by each salesman and as much of their methods as they would write in to him, but also he began to go around among the agencies himself and to publish in the paper the most interesting experiences that he encountered.”

“A man who made a good record had his picture printed in The N. C. R. with an account of what he had done - Patterson did this partly to reward the man and partly to challenge all the other men to go and do likewise.”

“The men who sold their full quotas were designated members of the Hundred Point Club and invited to Dayton for the annual convention. The man who first got his quota in the year was the president of the club, the second man was the vice-president, and the third was the secretary, and the fourth was the treasurer. Thus evolved a unique organization of best salesmen, and each year since its inception the club conventions have been growing in importance until they now are the event of the Dayton year.”

Guaranteed Territories - Sharing Ideas

“We bring all of you people together and we ask one person and another person to get up and talk and then we ask for criticisms and suggestions. “Now, why do we do that? We couldn’t do that if we didn’t have guaranteed territories. You people wouldn’t be here to teach others to go into your territory and sell goods in your territory and get all the benefit of what you know. You would keep everything to yourselves. Guaranteed territory prevents all that and therefore you are able to come here and help each other.”

Value Employees

“The success of this company has been due to the enthusiasm we have been able to inspire in it, by persevering, by coaxing, by forcing, by recognising merit, by publishing good things done, by offering prizes. To be successful you must not only have ability but you must treat your men so that they will have confidence in you and in the company."

“Patterson began the idea of the modern factory; a place in which human beings might work in the greatest comfort, with entire self-respect and with the highest efficiency. The old idea was that a factory was just a place to work and that the employees were ‘hands.’"

"Labour is suspicious- and has a right to be. Generally speaking, it is not fairly treated and it has not been given either its rightful share in industry or its proportion of income. The idea has been to get everything that is to be had out of a man, keep him down, regulate his wages by the smallest amount he will take and not by what he is worth, and when he is worn out, to throw him off like an old shoe.”

“Enthusiasm is the biggest asset in business. It is the one thing that you have to work eternally to keep up. The N. C. R. was built by the enthusiasm of the organization both in the shops and in the field.”

“I have found that a man lacks enthusiasm when:

He has not an appreciation of the work in hand.

He is out of sympathy with what you are doing.

He lacks knowledge of the business and the motives of the officers.

He is not in harmony with his surroundings.

He does not realise his obligations.

“Treat people well and they will treat you well. They will not instantly respond but they will in the long run. Be square with them.”

"Do not try to take any advantage and do not try to get the last cent's worth of energy out of them. They will give you their best if they think you are giving them your best; they will not work the better for being forced.”

"It pays to do good; it pays to help them to help themselves in every moral and physical way and also to give them every possible opportunity for advancing to higher positions and more money.”

“We take the attitude that if anything more can be done not reasonably done, but if it can be done at all for the improvement of comfort or safety, we will do it.”

Source: ‘From One to a Million’ 1911.

“I am so thoroughly convinced that it pays that I would recommend changes to keep labour happy no matter what might be the immediate effect upon our business, for it is only the ultimate effect that counts.”

“Probably no individual ever did as much as Mr. Patterson toward providing for the pleasure and recreation of those who worked with him.”

“Every plan of the N. C. R. was designed to estimate men by their results and then to pay them by their results. Whenever possible he liked to overpay.”

“The more we do for our employees, the better work they can do.”

“We found that people do the best work when they are best cared for. Nothing is more important to workers than good food. Three dining rooms are operated for our employees. Warm, substantial, well-cooked meals are furnished at cost, and often less than cost.”

“Mr. Patterson's policy of trying always to have the N. C. R. do more for those who work for it wholeheartedly than any other company had ever thought of doing for its people. For that was Mr. Patterson's way with men.”

“For a factory was to Mr. Patterson not an assorted lot of bricks and mortar surrounding an assorted lot of iron and steel contrivances. A factory to him was a collection of human beings.”

Source: ‘From One to a Million’ 1911.

“During the critical years when the N. C. R. was building, a fair portion of the citizens of Dayton and all the politicians did everything in their power to block any movement which might benefit the N. C. R. Mr. Patterson was regarded as a menace. For who had ever heard of treating employees the way he treated them, or paying higher wages than it was necessary to pay? And why have so much nonsense about buildings and landscape gardening? Why not run a factory instead of a show?”

“Mr. Patterson believed that clubs promoted social and business intercourse, understanding, and cooperation. He inspired the organisation of the Dayton Woman's Club and largely financed the purchase of its fine clubhouse. In the factory he organised the Advance and Progress Club for executives, in addition to the Woman's Century Club for women employees, and the N. C. R. Women's Club for the women of N. C. R. employees' families. The Old Barn Club was the personal property of Mr. Patterson, but he turned it over to public use in order to provide country club advantages.”

“Workers are entitled to decent and comfortable surroundings at their work. Good working conditions keep workers healthy and happy and add to their self-respect. No employer can afford to provide work places that injure the efficiency of employees. When workers are contented they do more and better work."

Incentives

"Keeping workmen is not altogether a matter of wages, but the wages are of the highest importance. I have always believed in paying men well, but paying them on results. Every job that can be so arranged is on the piece-work basis; we encourage the making of the highest possible wages.”

Staff Turnover

“Our labour turnover is trivial when compared with most concerns of our size.”

Promote from Within

“Patterson’s ventures in hiring stars were all failures and the men who really helped him make the company were all men who had come up through the ranks.”

Walk the Floors

“Mr. Patterson moved his desk out among the machinery and at once he began in his characteristic way to work through the men toward the product. He began to call meetings of the foremen and job foremen.”

“When the business was smaller I used to travel about through the shops a great deal, knowing everyone, and taking pains to ask them if they had anything to suggest. Then I had them in meetings and I called for suggestions.”

“Patterson for the first time really saw what the agents were doing, he had never before inspected the front-line trenches. He had stayed at headquarters. But after that trip no executive of the company was ever permitted long to remain at headquarters; they were supposed to be out on the road holding conventions of salesmen and finding out why registers were being sold or why they were not being sold.”

Harness Technology

“Much of the work in this factory is done with the aid of machinery. Improved machinery has enabled us to do many things more quickly and better than they were done in the past. It enables us to pay high wages and still sell our cash registers at such low prices. Machinery makes men dear, their products cheap.”

Training

"Teaching is my hobby and we provide the means to find knowledge. The employees have to go to some trouble to stop learning. It takes many forms and directions.“

“Then began the idea of holding night classes so that the employees could learn how to get better jobs for themselves. The whole atmosphere gradually became one of teaching and as such it continued--with the N. C. R. as a university and with every executive and employee, from Mr. Patterson down, as students.”

“When Building No. 3 was finished, part of it was turned into a large schoolroom - an unheard-of idea at the time. Many manufacturers inquired whether Mr. Patterson was running a business or a school. His invariable reply was: ‘Business is only teaching.’”

Ideas

“Out of the plan to hold forth rewards for thinking came the suggestion system for the factory force, the profit-sharing plan for both the factory and office, and the famous Hundred Point Club for the salesmen. The suggestion system was another of Mr. Patterson's new ideas.”

“I was depending solely for ideas upon myself and upon the comparatively few men about me, and I had no means of knowing who were the bright lads scattered throughout the organisation. That is, I was not only throwing away the brains of about five thousand people, which should have been concentrated in making business better.”

“The suggestion system which has grown and grown until in one year some 3,200 suggestions were submitted.”

“We decided that a complaint was truly a suggestion leading to an improvement, and therefore to-day both complaints and suggestions are on the same basis. We placed all over the factory suggestion boxes in which any member of the organisation might place his idea and we gave one dollar apiece for suggestions or complaints.”

“Instead of paying for a suggestion we found that greater enthusiasm was aroused and more suggestions offered by making a contest. We have two contests in each year, one ending June 30th and the other December 31st. Twelve hundred dollars is offered in 128 prizes; the best suggestion adopted receives $100, the next $75, the next $50, the next $30, the next three $25 each, the next six $20 each, the next thirty-five $10 each.”

“We ask [employees] for help from them on all divisions of the business.”

“Most of the mechanical improvements in the cash register of today are due to suggestions from employees.”

“Take a typical six months. The number of suggestions received was 3,536; the number of suggestions adopted was 1,315 or 37.2 per cent scattered among 58% employees. Of these 128 received prizes.”

"The suggestions cover the entire mechanical and selling operation of our business, and although I regard the financial gain as highly important, I do not think that it is anything like as important as that other gain which we cannot measure in money- the bringing of men with ideas to top positions in our organisation.”

National Cash Register Employees Dayton Ohio - 1910

“With ideas it is different. It may very well be that the chap with the most active mind and who will do the most to promote the business will not necessarily be the most expert with his hands. Indeed, the best idea men are not commonly the most expert workmen. I have found that the very active brain does not as a rule seem to go with the super-skilled hand,”

“The employee is encouraged to observe, think, and suggest, and that alone makes a better man of him. He knows that if he gets into the limelight through his suggestions he is going to get a better job.”

“Practically every one of our present factory executives and foremen reached his position through making suggestions.”

Local Focus

“It was Patterson’s constant aim to have as leaders for the various organisations natives of the respective countries, and eliminate everything American from the organisations that could in any way be objected to by the natives. Mr. Patterson was thoroughly international and felt at home in whichever country he has happened to visit. He respected and complied with the customs of each country and always impressed upon the leaders of the organisations that they should adapt our business and business methods as much as possible to local conditions.”

Delegation

“Mr. Patterson [had the] new idea of deliberate delegation of duties; the old idea of business was that the executive should delegate to others only that for which he could not find time himself. The new idea of Mr. Patterson's was that an executive should do only what he could not delegate that the chief business of an executive was to think and to plan. Hence his motto: “Never do anything if you can get someone else to do it.”

“That business is best which requires the least attention from the head. The pyramid plan of organisation is used at this factory. Everyone has certain duties and responsibilities. This permits the management to give a part of their time to planning for the future.”

“Mr. Patterson was a strong believer in giving authority and placing responsibility on the officers and employees of the company, and by placing confidence in them he made them self-relying.”

Emergent Effects

“When a few men try to carry the entire load the business suffers. It does not progress as it should. When everyone shoulders his part of the responsibility it is much easier to go ahead. Great tasks can only be accomplished by the assistance of all parts of an organisation.”

Fanatic

“Mr. Patterson would not tolerate the sort of man who amasses a fortune, calls himself successful, and retires to bask in the light of past performance. When something was finished, Mr. Patterson crossed it off his chart and went on with the next thing. And when he died his chart was fuller of things to do than at any time before in his life.”

“It is to be remembered that he started late that he was past forty before he took on the N. C. R. He fought, and he worked night and day against odds almost impossible to realise. Often, had he admitted to himself the possibility of being bankrupt, he would have been bankrupt. Not recognising failure, he could not fail. He expected obstacles and it did not make much difference what kind of obstacles at the moment stood in his way he had accustomed himself to dealing with all kinds.”

“Every day Patterson made notes of the things that he should not have done during that day and resolved not to do them again.”

“Men do not do big things in dilettante fashion—they put their whole selves in their work, making all else subordinate.”

Keep it Simple

“The great company was brought about—step by step and by methods which, although they sound pretentious in generalisation, were exquisitely simple.”

Humility

“Patterson had no conception of leisure. Patterson detested the "idle rich"; whenever he heard of a man building a palace or spending some great sum on a necklace, he usually drew a chart to show how much good that man missed doing by not devoting the money to education or to the saving of babies. He never bought an expensive painting in his life; he was not opposed to purchases in the interest of the public, but he spoke bitterly of those who would pay a quarter of a million for a canvas to hang in their own homes where only they and their friends could have the benefit.”

“Patterson considered himself only a trustee of what he earned, and his expenditures had to be governed by the laws he made for his trusteeship. He expressed his whole theory of the use of money and of the function of the large corporation in pyramid form and it explains intimately how he shaped his life.”

“Mr. Patterson gives to deserving but unfortunate employees and to others. He keeps only enough for his board and clothes and necessaries for himself and children. He has no outside investments except Hills and Dales which the people enjoy with him. On his last trip he can take nothing with him, as shrouds have no pockets.”

“Patterson believed in the equality of effort, not of remuneration. A workman earning twenty-five dollars a week for good work stood just as high with him as an executive drawing fifty thousand dollars a year. When he found the office girls were holding themselves above the factory girls because they could wear better clothing while at work he put all the girls in the organization into white aprons.”

Multi-Disciplinary & Learning

“It must be remembered that Mr. Patterson was an almost uncannily skilled adapter rather than an originator; the line between adapting and originating is hard to draw for he got suggestions from quarters where no other human being would have found them and then turned them in such fashion that no one else would have recognised the suggestion.”

“Patterson read or had read for him every business publication; if he found good ideas in a book or magazine article, he bought hundreds of copies and sent them to his executives. He was always learning and he expected everyone about him to be learning.”

Summary

In his annual Berkshire letter, Buffett emphasizes that he and Charlie prioritize picking wonderful businesses over selecting stocks. This approach, which involves identifying the characteristics of exceptional businesses, buying them, and holding them for the long term, has been key to Berkshire Hathaway's success.

John H Patterson, a visionary leader, implemented several innovative strategies that propelled National Cash Register to become one of the most successful companies of its time. As Charlie Munger put it, Patterson "surfed" a technology evolution while delivering customers far more in value than their cost. Patterson's focus on empowering workers, promoting reciprocation, selling based on value-add, sharing profits, striving for continuous improvements, and soliciting ideas from front-line employees helped create an exceptional business that continues to inspire successful companies today.

These principles are based on fundamental truths: customers reward outstanding service, employees want to feel valued and incentivized, innovation comes from trial and error, sharing information adds value, hard work leads to results, and mistakes are opportunities for learning. Ultimately, customers want to be delighted. Keep these principles in mind when evaluating a business, as they have been proven to work time and time again. The fact they form the foundation of Charlie Munger’s recommended study into the investment process, suggests they can add value to each of us.

Sources:

“John H. Patterson: Pioneer in Industrial Welfare,” Samuel Crowther, Doubleday, Page & Company, 1923.

Picture Credits - NCR Annual Report 1906 - h/t Jessie Rancourt

Follow us on Twitter : @mastersinvest

Visit the Blog Archive

TERMS OF USE: DISCLAIMER

![S Truett Cathy [Source: Chick-fil-A]](https://images.squarespace-cdn.com/content/v1/568cf1da4bf1182258ed49cc/1625470889696-3YKLQ7FZUYR7FHDT7U7X/truett-web.jpg)

![S&P500 [grey] vs General Electric [blue] Normalised - 2000 - 2021 [Source: Bloomberg]](https://images.squarespace-cdn.com/content/v1/568cf1da4bf1182258ed49cc/1626240958557-MQY5UOVVQ98IF9CHHKM1/Screen+Shot+2021-07-14+at+3.33.36+pm.png)

![Estée Lauder vs SP500 1995-2021 [Source: Bloomberg]](https://images.squarespace-cdn.com/content/v1/568cf1da4bf1182258ed49cc/1622953763962-A339S3D8A10QJA6BVXPE/Screen+Shot+2021-06-06+at+2.28.10+pm.png)

![Dow Jones Industrial Average - 1987 Crash [Source; Bloomberg].](https://images.squarespace-cdn.com/content/v1/568cf1da4bf1182258ed49cc/1616478903417-5MBL252INY28HCUPDPYG/dow.PNG)

![Disney Corporation vs S&P500 - March 2005 to 2021 [Source: Bloomberg]](https://images.squarespace-cdn.com/content/v1/568cf1da4bf1182258ed49cc/1613102921408-U4VQK7OGPQ515OR2Y2LI/dischart.JPG)