The Munger Series - Learning from Benjamin Franklin

Charlie Munger never stopped learning. From a young age, his parents instilled in him the virtues of continuous education. This lifelong pursuit of knowledge mirrored that of Benjamin Franklin, who shared a deep curiosity for life and a love of books. Warren Buffett even joked that scholars might question whether Charlie was a reincarnation of Ben Franklin, reflecting the profound influence Franklin had on him.

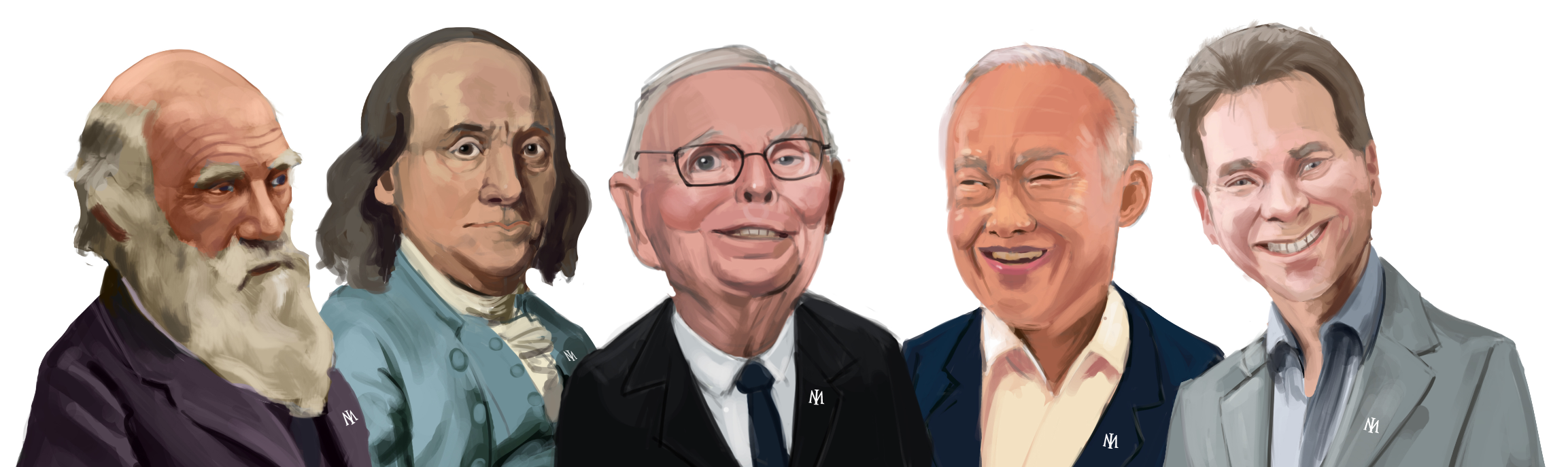

Charlie Munger had many heroes, but none more significant than Ben Franklin, one of the select few "towering intellectuals" Munger admired and learned from. In previous blog posts, we’ve explored many of Munger’s mentors, including Darwin, Cialdini, Einstein, Da Vinci, and Lee Kuan Yew. Recently, I picked up Walter Isaacson’s book, "Benjamin Franklin: An American Life," to delve deeper into the life of this figure Munger revered.

Benjamin Franklin's life is a quintessential rags-to-riches story. Starting in poverty and obscurity, Franklin dedicated himself to lifelong learning and rose to become one of America's most distinguished figures. At 17, Franklin ran away from his home in Boston, seeking to forge his own path. He found work in Philadelphia as a printer, where his industrious nature and keen intellect soon propelled him to become a publisher in his own right. By 42, Franklin had built a successful printing business, but his insatiable curiosity led him to leave the business world to pursue a wide array of interests, from science to politics. His scientific achievements, particularly in electricity, elevated his profile in Europe, granting him audiences with influential figures and enabling him to achieve significant diplomatic successes for the emerging United States.

Frugal, purposeful, and committed to societal betterment, Benjamin Franklin was instrumental in securing America’s independence. He was the only person to sign all four key documents that underpinned America’s prosperity: the Declaration of Independence, the Treaty of Alliance with France, the Treaty of Paris, and the United States Constitution. Through his diplomacy, wisdom, and visionary leadership, Franklin played a crucial role in shaping the nation's early direction and ensuring its long-term success.

Benjamin Franklin's legacy is rich with lessons, particularly in how his personal attributes influenced Munger's achievements. Beyond that, Franklin's bold vision to emancipate America from the entrenched class system of the UK stands as a testament to his foresight. By championing the American middle class, Franklin laid the foundation for a social structure that has fostered widespread advancement. The same characteristics that lead to individual accomplishments and national progress were those Munger recognized and valued in business.

Below, you’ll find aphorisms and excerpts from Isaacson’s book that highlight many of these characteristics.

Franklin’s Aphorisms

“He that lies down with dogs shall rise up with fleas.”

“A good example is the best sermon.”

“None preaches better than the ant, and she says nothing.”

“The sleeping fox catches no poultry.”

“Diligence is the mother of good luck.”

“He that pursues two hares at once does not catch one and lets the other go.”

“Search others for their virtues, thyself for thy vices.”

“Haste makes waste... Make haste slowly.”

“He who multiplies riches multiplies cares.”

“No gains without pains.”

“There was never a good knife made of bad steel.”

“(Knowledge is) obtained rather by the use of the ear than of the tongue.”

“It is hard for an empty sack to stand upright.”

Purpose Not Money

“Accumulating money was not Franklin's goal. Despite the pecuniary spirit of Poor Richard's sayings and the penny-saving reputation they later earned Franklin, he did not have the soul of an acquisitive capitalist. ‘I would rather have it said,’ he wrote his mother, ‘He lived usefully,' than, 'He died rich?’

So, in 1748 at age 42-which would turn out to be precisely the midpoint of his life he retired and turned over the operation of his printing business to his foreman. The detailed partnership deal Franklin drew up would leave him rich enough by most people's standards: it provided him with half of the shop's profits for the next eighteen years, which would amount to about £650 annually.

Back then, when a common clerk made about £25 a year, that was enough to keep him quite comfortable. He saw no reason to keep plying his trade to make even more. Now he would have ‘leisure to read, study, make experiments, and converse at large with such ingenious and worthy men as are pleased to honor me with their friendship.’"

“Franklin was not aspiring, by his retirement, to become merely an idle gentleman of leisure. He left his print shop because he was, in fact, eager to focus his undiminished ambition on other pursuits that beckoned: first science, then politics, then diplomacy and statecraft.”

“Unlike in some of his other pursuits, he was not driven by pecuniary motives; he declined to patent his famous inventions, and he took pleasure in freely sharing his findings.”

“‘An inclination joined with an ability to serve mankind, one's country, friends and family.’ That, Franklin declared in conclusion, ‘should indeed be the great aim and end of all learning.’”

“As Poor Richard said in his almanac that year, ‘Lost time is never found again.’”

A Polymath

“During his life he was celebrated as the most famous scientist alive, and recent academic studies have restored his place in the scientific pantheon. As Harvard professor Dudley Herschbach declares, ‘His work on electricity was recognized as ushering in a scientific revolution comparable to those wrought by Newton in the previous century or by Watson and Crick in ours.’”

“Even when he was young, Franklin's intellectual curiosity and his Enlightenment-era awe at the orderliness of the universe attracted him to science. During his voyage home from England at age 20, he had studied dolphins and calculated his location by analyzing a lunar eclipse, and in Philadelphia he had used his newspaper, almanac, the Junto, and the philosophical society to discuss natural phenomena.”

“Franklin’s scientific interests would continue throughout his life, with research into the Gulf Stream, meteorology, the earth's magnetism, and refrigeration.”

“Franklin was a practical experimenter more than a systematic theorist.”

“Franklin was one of the foremost scientists of his age, and he conceived and proved one of the most fundamental concepts about nature: that electricity is a single fluid.”

“Franklin quickly became not only the most celebrated scientist in America and Europe, but also a popular hero. In solving one of the universe's greatest mysteries, he had conquered one of nature's most terrifying dangers.”

Multi-Disciplinary

“As with his moral and religious philosophy, Franklin's scientific work was distinguished less for its abstract theoretical sophistication than for its focus on finding out facts and putting them to use.”

“Franklin would soon apply his scientific style of reasoning - experimental, pragmatic—not only to nature but also to public affairs.”

“Franklin’s political pursuits would be enhanced by the fame he had gained as a scientist. The scientist and statesman would henceforth be inter-woven, each strand reinforcing the other, until it could be said of him, ‘He snatched lightning from the sky and the scepter from tyrants.’”

Beyond Dogma

“In his political philosophy, as in his religion and science, Franklin was generally non-ideological, indeed allergic to anything smacking of dogma. Instead, he was, as in most aspects of his life, interested in finding out what worked.”

“‘Declarations of a fixed opinion, and of determined resolution never to change it, neither enlighten nor convince us,’ Franklin said.”

“With the wisdom of a patient chess player and the practicality of a scientist, Franklin realized that they had succeeded not because they were self-assured, but because they were willing to concede that they might be fallible. ‘We are making experiments in politics,’ he wrote. ‘For, having lived long, I have experienced many instances of being obliged, by better information or fuller consideration, to change opinions even on important subjects, which I once thought right, but found to be otherwise. It is therefore that, the older I grow, the more apt I am to doubt my own judgment and pay more respect to the judgment of others.”

“Most men, indeed as well as most sects in religion, think themselves in possession of all truth, and that wherever others differ from them, it is so far error.”

“There's something to be said for Franklin's outlook, for his pragmatism and occasional willingness to compromise. He believed in having the humility to be open to different opinions. For him that was not merely a practical virtue, but a moral one as well. “

Empowerment of the Middle Class

“What made him a bit of a rebel, and later much more of one, was his inbred resistance to establishment authority. Not awed by rank, he was eager to avoid importing to America the rigid class structure of England.”

“Franklin believed in encouraging and providing opportunities for all people to succeed based on their diligence, hard work, virtue, and ambition.”

“At its core was a somewhat new concept that became known as federalism. A ‘General Government’ would handle matters such as national defense and westward expansion, but each colony would keep its own constitution and local governing power. Though he was sometimes dismissed as more of a practitioner than a visionary, Franklin had helped to devise a federal concept - orderly, balanced, and enlightened—that would eventually form the basis for a unified American nation.”

“Franklin added what would become a revolutionary cry: ‘Those who would give up essential liberty to purchase a little temporary safety deserve neither liberty nor safety.’”

“Much of what Franklin saw in Ireland distressed him. England severely regulated Irish trade, and absentee English landlords exploited Irish tenant farmers. ‘They live in wretched hovels of mud and straw, are clothed in rags, and subsist chiefly on potatoes,’ he noted. His shock at the disparity between rich and poor made him all the more proud that America was building a vibrant middle class. The strength of America, he wrote, was its proud freeholders and trades-men, who had the right to vote on public affairs and ample opportunity to feed and clothe their families.”

Source: ‘Poor Charlie’s Almanac’

“Over the years, Franklin had been developing a social outlook that, in its mixture of liberal, populist, and conservative ideas, would become one archetype of American middle-class philosophy. He exalted hard work, individual enterprise, frugality, and self-reliance. On the other hand, he also pushed for civic cooperation, social compassion, and voluntary community improvement schemes. He was equally distrustful of the elite and the rabble, of ceding power to a well-born establishment or to an unruly mob. With his shopkeeper's values, he cringed at class warfare. Bred into his bones was a belief in social mobility and the bootstrap values of rising through hard work.”

“Franklin’s ideal was of a prosperous middle class whose members lived simple lives of democratic equality. Those who met with greater economic success in life were responsible to help those in genuine need; but those who from lack of virtue failed to pull their own weight could expect no help from society.”

A New Social Order

“As a publishing magnate and then as a postmaster, he was one of the few to view America as a whole. To him, the colonies were not merely disparate entities. They were a new world with common interests and ideals.”

“When Englishmen such as his father had immigrated to a new land, they had bred a new type of people. As Franklin repeatedly stressed in his letters to his son, America should not replicate the rigid ruling hierarchies of the Old World, the aristocratic structures and feudal social orders based on birth rather than merit. Instead, its strength would be its creation of a proud middling people, a class of frugal and industrious shopkeepers and tradesmen who were assertive of their rights and proud of their status.”

“Franklin had imbibed the philosophy of the new Enlightenment thinkers, who believed that liberty and tolerance were the foundation for a civil society.”

“Once it was clear that Britain remained intent on subordinating its colonies, the only course left was independence.”

“‘Tyranny is so generally established in the rest of the world that the prospect of an asylum in America for those who love liberty gives general joy, and our cause is esteemed the cause of all mankind… We are fighting for the dignity and happiness of human nature,’ Franklin proclaimed. ‘Glorious it is for the Americans to be called by Providence to this post of honor.’ A few weeks later, he wrote in a similar vein to a Boston friend, concluding, ‘It is a common observation here that our cause is the cause of all mankind, and that we are fighting for their liberty in defending our own.’”

“In free Governments the rulers are the servants, and the people their superiors and sovereigns. For the former therefore to return among the latter was not to degrade but to promote them.”

“Franklin came to symbolize, a new political order in which rights and power were based not on the happenstance of heritage but on merit and virtue and hard work. He rose up the social ladder, from runaway apprentice to dining with kings, in a way that would become quintessentially American.”

“(Franklin was the) most accomplished American of his age and the most influential in inventing the type of society America would become. Indeed, the roots of much of what distinguishes the nation can be found in Franklin: its cracker-barrel humor and wisdom; its technological ingenuity; its pluralistic tolerance; its ability to weave together individualism and community cooperation; its philosophical pragmatism; its celebration of meritocratic mobility; the idealistic streak ingrained in its foreign policy; and the Main Street (or Market Street) virtues that serve as the foundation for its civic values.”

“Franklin’s vision of how to build a new type of nation was both revolutionary and profound.”

“Through it all, Franklin trusted the hearts and minds of his fellow leather-aprons more than he did those of any inbred elite. He saw middle-class values as a source of social strength, not as something to be derided. His guiding principle was a ‘dislike of everything that tended to debase the spirit of the common people.’ Few of his fellow founders felt this comfort with democracy so fully, and none so intuitively.”

America’s True Value

“Franklin's key insight was that hard currency, such a silver and gold, was not the true measure of a nation's wealth: ‘The riches of a country are to be valued by the quantity of labor its inhabitants are able to purchase, and not by the quantity of silver and gold they possess.’”

“(Franklin’s) essay was very popular, except among the wealthy, and it helped to persuade the legislature to adopt the proposed increase in paper currency.”

Negotiation

“Franklin stressed the importance of deferring, or at least giving the appearance of deferring, to others. Otherwise, even the smartest comments would ‘occasion envy and disgust.’ His secret for how to win friends and influence people read like an early Dale Carnegie course: ‘Would you win the hearts of others, you must not seem to vie with them, but to admire them. Give them every opportunity of displaying their own qualifications, and above others... Such is the vanity of mankind that minding what others say is a much surer way of pleasing them than talking well ourselves.’”

“The older he got, the more Franklin learned (with a few notable lapses) to follow his own advice. He used silence wisely, employed an indirect style of persuasion, and feigned modesty and naiveté in disputes. ‘When another asserted something that I thought an error, I denied myself the pleasure of contradicting him.’ Instead, he would agree in parts and suggest his differences only indirectly. ‘For these fifty years past no one has ever heard a dogmatical expression escape me,’ he recalled when writing his autobiography. This velvet-tongued and sweetly passive style of circumspect argument would make him seem sage to some, insinuating and manipulative to others, but inflammatory to almost nobody. The method would also become, often with a nod to Franklin, a staple in modern management guides and self-improvement books.”

“‘Positiveness and warmth on one side, naturally beget their like on the other.’ He had personally been willing, he said, to revise many of his opinions… He gently emphasized, in a homespun analogy that drew on his affection for craftsmen and construction, the importance of compromise: ‘When a broad table is to be made, and the edges of planks do not fit, the artist takes a little from both, and makes a good joint. In like manner here, both sides must part with some of their demands.’”

“Already the greatest American scientist and writer of his time, he would display a dexterity that would make him the greatest American diplomat of all times.”

“‘The game of chess is not merely an idle amusement,’ Franklin began. ‘Several very valuable qualities of the mind, useful in the course of human life, are to be acquired or strengthened by it. For life is a kind of chess, in which we have often points to gain and competitors or adversaries to contend with.’ Chess, he said, taught foresight, circumspection, caution, and the importance of not being discouraged. There was also an important etiquette to be practiced: never hurry your opponent, do not try to deceive by pretending to have made a bad move, and never gloat in victory: ‘Moderate your desire of victory over your adversary, and be pleased with the one over yourself.’ There were even times when it was prudent to let an opponent retract a bad move: ‘You may indeed happen to lose the game to your opponent, but you will win what is better, his esteem.’”

“From his opening gambit that led to Americas treaty of alliance with France to the endgame that produced a peace with England while preserving French friendship, Franklin mastered a three-dimensional game against two aggressive players by exhibiting great patience when the pieces were not properly aligned and carefully exploiting strategic advantages when they were.”

Morals

“Franklin used his pamphlet to denounce prejudice and make the case for individual tolerance that was at the core of his political creed. ‘If an Indian injures me, does it follow that I may revenge that injury on all Indians?’ he asked. ‘The only crime of these poor wretches seems to have been that they had a reddish brown skin and black hair.’ It was immoral, he argued, to punish an individual as revenge for what others of his race, tribe, or group may have done. ‘Should any man with a freckled face and red hair kill a wife or child of mine, [by this reasoning] it would be right for me to revenge it by killing all the freckled red-haired men, women and children I could afterwards anywhere meet.’”

Hard Work

“Those who study hard, Franklin wrote, ‘live comfortably in good houses,’ whereas those who are idle and neglect their schoolwork ‘are poor and dirty and ragged and ignorant and vicious and live in miserable cabins and garrets.’

"‘Industry and constant employment are great preservatives of morals and virtue.’ He purported to be describing the way America was, but he was also subtly prescribing what he wanted it to become. All in all, it was his best paean to the middle-class values he represented and helped to make integral to the new nation's character.”

War

“‘All wars are follies, very expensive, and very mischievous ones’, he wrote. ‘When will mankind be convinced of this, and agree to settle their differences by arbitration? Were they to do it, even by the cast of a die, it would be better than by fighting and destroying each other.’

“(Franklin’s) famous, albeit somewhat misleading, credo: ‘There never was a good war or a bad peace.’”

Summary

Benjamin Franklin's multifaceted success as a businessman, scientist, and key architect of American ideals provides enduring lessons for all. His influence on industrialists like Andrew Carnegie and Thomas Mellon is profound, with both citing Franklin's teachings as pivotal to their success. Franklin's pragmatic approach, his understanding of an empowered middle class, and his resistance to dogma underscore his unique philosophy. He championed virtues such as industriousness, frugality, and common sense, viewing these not just as personal traits but as foundational to a prosperous society.

Franklin’s legacy, as captured in Walter Isaacson's book, offers timeless wisdom that has guided many, including Charlie Munger. The parallels between Munger and Franklin are striking, both embodying lifelong learning, frugality, and a commitment to societal betterment. Munger’s business acumen and personal development are deeply influenced by Franklin’s values.

Franklin’s insights remain relevant today, illuminating a social structure that has enabled ordinary people to achieve extraordinary outcomes in both America and her businesses. His teachings inspire us to pursue personal and professional success while contributing to societal improvement. Franklin's life and wisdom continue to serve as a testament to the enduring value of pragmatic thinking and common sense. As Munger observed, "We've never had anybody quite like Franklin in this country. Never again."

Sources:

‘Benjamin Franklin - An American Life,’ Walter Isaacson, Simon & Schuster, 2003.

Further Reading:

‘The Munger Series,’ Investment Masters Class, 2024.

Follow us on Twitter : @mastersinvest

Visit the Blog Archive

TERMS OF USE: DISCLAIMER